The first step towards becoming a licensed real estate agent, is to get your license. Your sponsoring broker can help you if you're new to the industry. Although the sponsoring agent can give you valuable experience and knowledge in this area, it is your responsibility to market yourself and your business. You must promote yourself after your license has been granted. To build a positive name, you will need to promote your business.

You can feel confident when you go to your real estate licensing exam.

Exam prep packages are a great way for real estate license preparation. These packages include everything you need, from practice tests and practice exams to webinars and training materials. Some courses even include flash cards and ebooks. The best part is that these courses come with a money-back guarantee! Give them a shot! Here are some ways to get started.

Mbition is one such company. Its test prep package includes a personalized study plan, practice tests and flashcards. You will also find material about real estate contracts and legal issues. These exam prep classes are priced according to the state and number of practice sessions you purchase. For as little as $49, you can still get a basic nationwide exam preparation course. A state-specific exam prep program is also available if you don’t wish to invest too much.

Requirements

Virginia real estate agents can only be licensed if they are at least 18 years of age and have a highschool diploma. If you have no criminal convictions, you must complete a pre-license course, take PSI Exams, and then complete an interview with the broker of your choice. Once you've passed your interview, you can submit your application to the Real Estate Board. After completing the required coursework, you will be eligible to practice real estate in Virginia.

In order to become a real estate agent in Virginia, you must have full reciprocity with other states. A license from another state is required to become a Virginia licensed agent. Virginia licenses agents who have had at least 24 months real estate experience. You don't have to complete any prelicensing classes if you have a license issued by another state.

To pass the exam, you must meet certain conditions

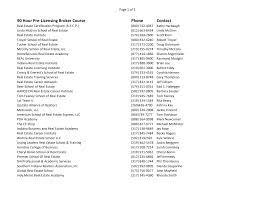

The education requirements for real estate agents in Virginia are something you might be interested in. 60 hours of pre-licensing education is required to become a licensed agent. You can complete these courses through online learning platforms or local community colleges. Before you sit for the real estate exam, you must take a course called Principles and Practices of Real Estate for Salespersons. This course will give you an overview of real estate concepts, including Virginia's laws. This course will prepare you to take the state exam once you have passed it.

To become a Virginia real estate agent, you must have your fingerprints taken. The Board requires applicants submit fingerprints in order to pass a background inspection. At PSI testing centers, fingerprints can be taken. For fingerprinting, you can visit any testing center in Virginia if you are taking the written test. Once you pass the exam your fingerprints and background check will be done by the Virginia Central Criminal Records Exchange.

FAQ

What are the disadvantages of a fixed-rate mortgage?

Fixed-rate mortgages have lower initial costs than adjustable rates. You may also lose a lot if your house is sold before the term ends.

How long does it take for a mortgage to be approved?

It depends on many factors like credit score, income, type of loan, etc. Generally speaking, it takes around 30 days to get a mortgage approved.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Should I use an mortgage broker?

Consider a mortgage broker if you want to get a better rate. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before you sign up for a broker, make sure to check all fees.

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. Refinances are usually allowed once every five years in both cases.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How do you find an apartment?

When moving to a new area, the first step is finding an apartment. This takes planning and research. This includes researching the neighborhood, reviewing reviews, and making phone call. There are many ways to do this, but some are easier than others. Before you rent an apartment, consider these steps.

-

Data can be collected offline or online for research into neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Offline sources include local newspapers, real estate agents, landlords, friends, neighbors, and social media.

-

Read reviews of the area you want to live in. Yelp. TripAdvisor. Amazon.com have detailed reviews about houses and apartments. Local newspaper articles can be found in the library.

-

To get more information on the area, call people who have lived in it. Ask them about their experiences with the area. Also, ask if anyone has any recommendations for good places to live.

-

Consider the rent prices in the areas you're interested in. Consider renting somewhere that is less expensive if food is your main concern. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out information about the apartment block you would like to move into. It's size, for example. What price is it? Is the facility pet-friendly? What amenities is it equipped with? Can you park near it or do you need to have parking? Are there any special rules that apply to tenants?