It is an easy way to make a million bucks by investing in real estate. This type of investment can offer a variety of tax benefits as well as the possibility of long-term appreciation. It's important to remember that it is not as easy as it seems to become a millionaire in real estate. It takes hard work and knowledge.

Before you can start making money in real estate, you need to decide where to start. Residential real estate is the best way to start. This is an easy and affordable way to get your foot in front of the door.

The classic real estate investment model involves buying a property and renting it out. Rent is used to cover maintenance, taxes, insurance, and other expenses. You can also generate passive income from it. The rental income can be used for debt repayments or to finance additional investments.

The classic real estate investment model is a bit trickier to implement, and you may not be able to generate cash flow from it right away. Instead, you may have to save up for a few years before you can afford to purchase a rental property. This is not always true for every investment. If you're interested in buying a luxury house, you should be familiar with the intricacies of selling it. You'll need to join the right brokerage and have basic sales experience.

To replicate the success of those who have been successful in the industry, it is possible to follow the footsteps of others. But keep in mind that your take-home salary will be much lower than theirs. For example, an average real estate agent earns $250,000 per year. To reach the same income level, you'll need to work approximately 20 years.

You should also consider real estate investments as a source for passive income. You can make passive income by investing in REITs. This allows you to both invest in properties and also receive a monthly distribution. You'll also be able to leverage your mortgage and invest in high-value homes.

By incorporating these key strategies into your investment strategy, you can easily become a millionaire with real estate. It is important to think big. A multi-unit building, or a property that has a long lease is an example of a property you might want to consider. These types of buildings appreciate more than single family homes.

The best way to make real estate investment is to invest in a mix of assets. For example, you might buy a house or condo and transform it into luxury rental units. You won't get a lot of income, but this could increase your equity. The passive income can be generated by investing in stocks and art.

The real estate market has been experiencing boom and bust cycles for several decades. During these periods, many people have been able to make millions using their real estate knowledge and skills.

FAQ

What are the benefits associated with a fixed mortgage rate?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans also come with lower payments because they're locked in for a set term.

What should you consider when investing in real estate?

The first step is to make sure you have enough money to buy real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

It is also important to know how much money you can afford each month for an investment property. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. It would be best to look at properties while you are away.

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you access to your home equity and allow you to live there while drawing down money. There are two types of reverse mortgages: the government-insured FHA and the conventional. With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. If you choose FHA insurance, the repayment is covered by the federal government.

How many times do I have to refinance my loan?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In either case, you can usually refinance once every five years.

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. Start saving now if your goal is to remain there for at least five more years. If you plan to move in two years, you don't need to worry as much.

How can I eliminate termites & other insects?

Your home will be destroyed by termites and other pests over time. They can cause serious destruction to wooden structures like decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

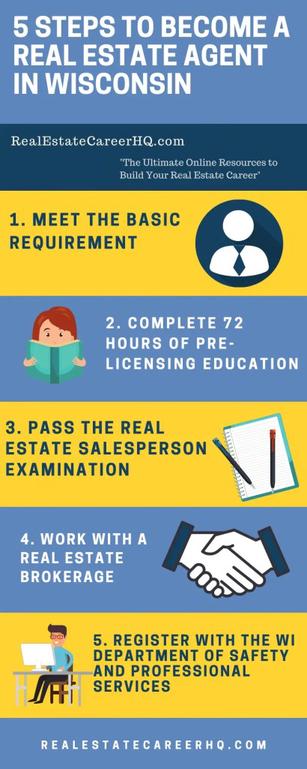

How to become an agent in real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next you must pass a qualifying exam to test your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

All these exams must be passed before you can become a licensed real estate agent.