If you are a military veteran, you can use your GI Bill to pay for your real estate license. You can use your GI Bill to pay for the actual course or licensing test. It also covers the cost of certification exams. More information is available from the Department of Veterans Affairs. You may be able to apply for reimbursement by contacting the Department of Veterans Affairs.

For military veterans, who are not currently in service, there are several options to get a license. First, scholarships are available to help with some of the cost. Dependent on the program, you may qualify for a scholarship up to $1,000. These scholarships can only be used for classes-based courses.

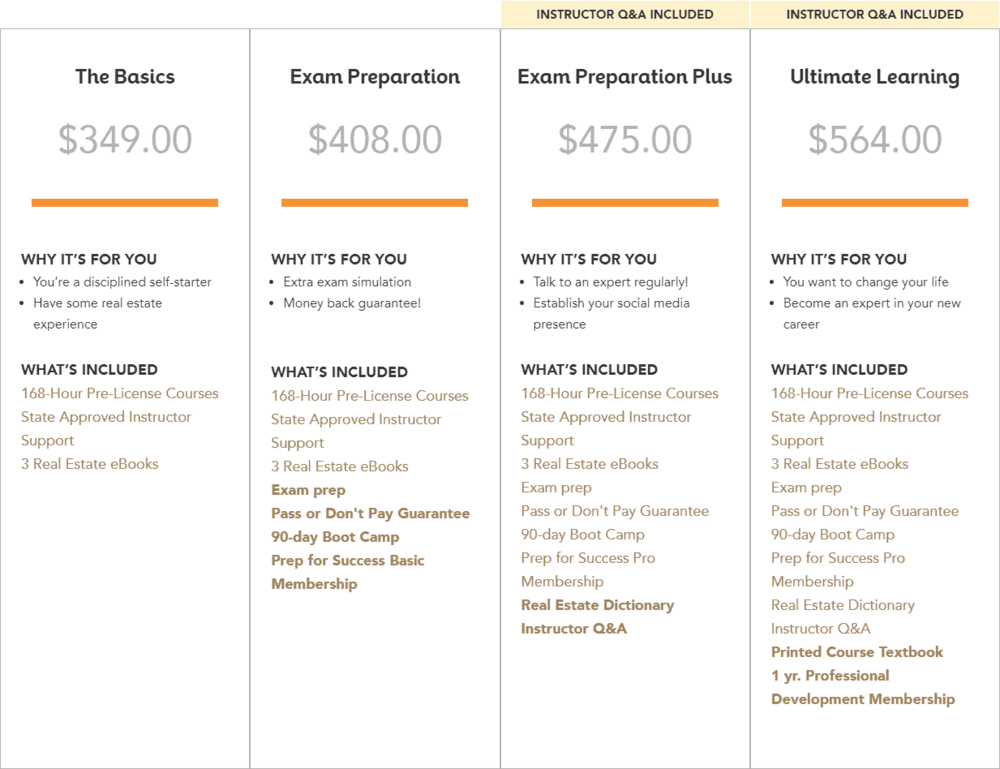

An alternative option to obtaining your license is to take an online pre-license course. AceableAgent provides a range of courses for anyone interested in getting a real estate licence. These courses come at a reasonable price and offer all the training required. However, additional costs for obtaining your license as a real estate agent will be charged to you.

Many national brokerages now offer programs for veterans. For example, the Northern Virginia Association of Realtors has a program to help transitioning service members get started in the industry. Interested veterans can submit a certificate proving that they are eligible and a DD214.

If you are not already a licensed real estate agent, you can take a pre-license course at Florida Real Estate University. The university offers a 63 hour pre-licensing sales associate class. Although there are fees, the VA will pay them. This will make it possible for you to start your real estate career in a matter of weeks.

Operation RE/MAX, another program that could help you, is also available. Operation RE/MAX is a program that matches veterans with mentors. This will allow them to start the process of becoming licensed as real estate professionals. The veteran and his spouse will then be required to commit for 24 months to the BHGRE Metro Brokers X-celerator program. They will be able to start work once they have passed the real estate exam.

A waiver can be requested by active-duty personnel for the initial licensing cost. This can be done online, or by sending a letter to the assessor. It is important to note that a waiver does not apply to the renewal of your license, or any criminal background checks.

Military service members have many benefits from the Texas Real Estate Commission. This includes an expedited process for applying. You may be eligible if you're a military member and hold a current state license.

The Veterans to REP program is open to both active and reserve military personnel. Military spouses have additional benefits. Both programs provide post-licensing support and training.

You can also contact the Department of Veterans Affairs and ask if you qualify for reimbursement of your certification and license fees. The VA website lists approved opportunities for real estate license reimbursement.

FAQ

Is it cheaper to rent than to buy?

Renting is generally cheaper than buying a home. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. The benefits of buying a house are not only obvious but also numerous. For example, you have more control over how your life is run.

Do I require flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance protects your belongings and helps you to pay your mortgage. Find out more about flood insurance.

What amount should I save to buy a house?

It depends on how much time you intend to stay there. It is important to start saving as soon as you can if you intend to stay there for more than five years. However, if you're planning on moving within two years, you don’t need to worry.

What is the average time it takes to sell my house?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It may take up to 7 days, 90 days or more depending upon these factors.

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. You won't need to worry about rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

How much money will I get for my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to buy a mobile house

Mobile homes are houses that are built on wheels and tow behind one or more vehicles. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. Mobile homes are still popular among those who wish to live in a rural area. These houses are available in many sizes. Some houses have small footprints, while others can house multiple families. There are some even made just for pets.

There are two main types mobile homes. The first is made in factories, where workers build them one by one. This occurs before delivery to customers. A second option is to build your own mobile house. It is up to you to decide the size and whether or not it will have electricity, plumbing, or a stove. You'll also need to make sure that you have enough materials to construct your house. The permits will be required to build your new house.

If you plan to purchase a mobile home, there are three things you should keep in mind. A larger model with more floor space is better for those who don't have garage access. A model with more living space might be a better choice if you intend to move into your new home right away. You should also inspect the trailer. Damaged frames can cause problems in the future.

You need to determine your financial capabilities before purchasing a mobile residence. It is important to compare the prices of different models and manufacturers. Also, take a look at the condition and age of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

Instead of purchasing a mobile home, you can rent one. Renting allows the freedom to test drive one model before you commit. Renting is not cheap. Most renters pay around $300 per month.