Do you ever feel that it is difficult to be a professional real estate agent? In my experience, it takes a lot of work to build a solid client base and become successful in the industry.

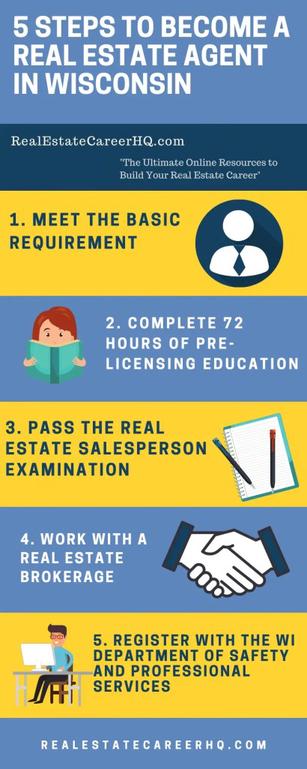

However, it is important to remember that being a real estate agent does not guarantee you a quick and easy income. It can take up to six months to obtain your license depending on the state you are in.

Finding your niche is the first step

If you want to become an agent in real estate, you need to pick an area you are passionate about. It could be personal preference, or based on real estate trends. Decide whether you want to specialize or not in residential real estate.

Once you have made your decision, you can begin the real-estate education process. Pre-licensing is the process of completing coursework and passing an exam administered by the state. Although the process can be lengthy, it is worthwhile to complete.

It's not as difficult as it seems. Generally, it involves completing specific real estate coursework, passing a state-administered test, and submitting your biometrics (fingerprinting and a background check) to the real estate commission of your state.

Step 2: Selecting Your Sponsoring Broker

Once you have your license, find a brokerage to help you get started and make your mark. They'll introduce and teach you about real estate. Mentorship opportunities will also be available.

They will also be able refer you to other agents when they are in need of an agent. That means a big payoff for you down the road!

Step 3: Getting your Business Off The Ground

In addition to the initial steps, you'll need to put a plan in place for your future. This plan should address how you'll manage your finances and set goals for yourself. It also needs to include what resources you need in order to stay competitive.

You'll need to establish your brand, find a target market for your services, and create marketing materials. It is also important to build relationships with potential clients.

The fourth step: Selling your home

There will be many properties and leads that you need to manage as a real-estate agent. This can make things difficult if there is no organized way to keep track. This is why it is crucial to use CRM tools to organize your contacts as well as automate follow-up communication.

The Fifth Step is to Take Care Of Your Clients

A career as a real-estate agent can be difficult, but rewarding. It is all about giving your best effort to the business and keeping track of your responsibilities.

Real estate agents are a great career choice. You need to make sure that you have enough money and time to pay for your start-up expenses and other expenses. This will allow for you to cover your living costs until you're ready.

FAQ

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They compare deals from different lenders in order to find the best deal for their clients. There are some brokers that charge a fee to provide this service. Some brokers offer services for free.

How much money should I save before buying a house?

It depends on how long you plan to live there. If you want to stay for at least five years, you must start saving now. But if you are planning to move after just two years, then you don't have to worry too much about it.

Do I require flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood insurance here.

How many times do I have to refinance my loan?

This depends on whether you are refinancing with another lender or using a mortgage broker. Refinances are usually allowed once every five years in both cases.

What is reverse mortgage?

Reverse mortgages allow you to borrow money without having to place any equity in your property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. If you choose FHA insurance, the repayment is covered by the federal government.

Can I buy my house without a down payment

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA, VA loans or USDA loans as well conventional mortgages. You can find more information on our website.

Is it possible to quickly sell a house?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. You should be aware of some things before you make this move. First, you must find a buyer and make a contract. Second, prepare your property for sale. Third, you must advertise your property. You should also be open to accepting offers.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Locate Houses for Rent

For people looking to move, finding houses to rent is a common task. It may take time to find the right house. When it comes to choosing a property, there are many factors you should consider. These factors include price, location, size, number, amenities, and so forth.

To make sure you get the best possible deal, we recommend that you start looking for properties early. For recommendations, you can also ask family members, landlords and real estate agents as well as property managers. This will give you a lot of options.